Preliminary Economic Assessment of the Re-scoped

Shymanivske Iron Ore Deposit

Since late 2016, there are strong indications that the iron ore market is evolving and favouring higher iron grade products (i.e. >62% Fe), such as BKI’s ultra-high grade of 68% Fe product, at the detriment of lower grades. This is mainly driven by Chinese steel mills seeking to become more efficient and reduce their environmental footprint. There is a prevailing sentiment that this trend will not subside and higher grade iron ore will continue to attract greater premiums.

Given these factors, BKI has taken the initiative of seeking to advance the Project by building it in phases with initial reduced scale, hence lower initial capital requirements to construct the Project. This is economically viable in BKI’s case given the close proximity of major infrastructure including rail, power, water and ports coupled with the use of local highly skilled low cost labour to construct and operate the Project.

The re-scoped Project considers a mining and mineral processing operation having an initial nominal capacity of 4.0 Mtpa of dry 68% Fe blast furnace pellet feed concentrate. The flowsheet and process equipment for the initial 4.0 Mtpa of concentrate will be replicated in order to double the production capacity with construction starting in Year 3 to allow for production of 8.0 Mtpa starting in Year 5 of production. This present re-scoped PEA replaces the previous 2014 Feasibility Study NI 43-101 Report as the current Report for the Shymanivske Project.

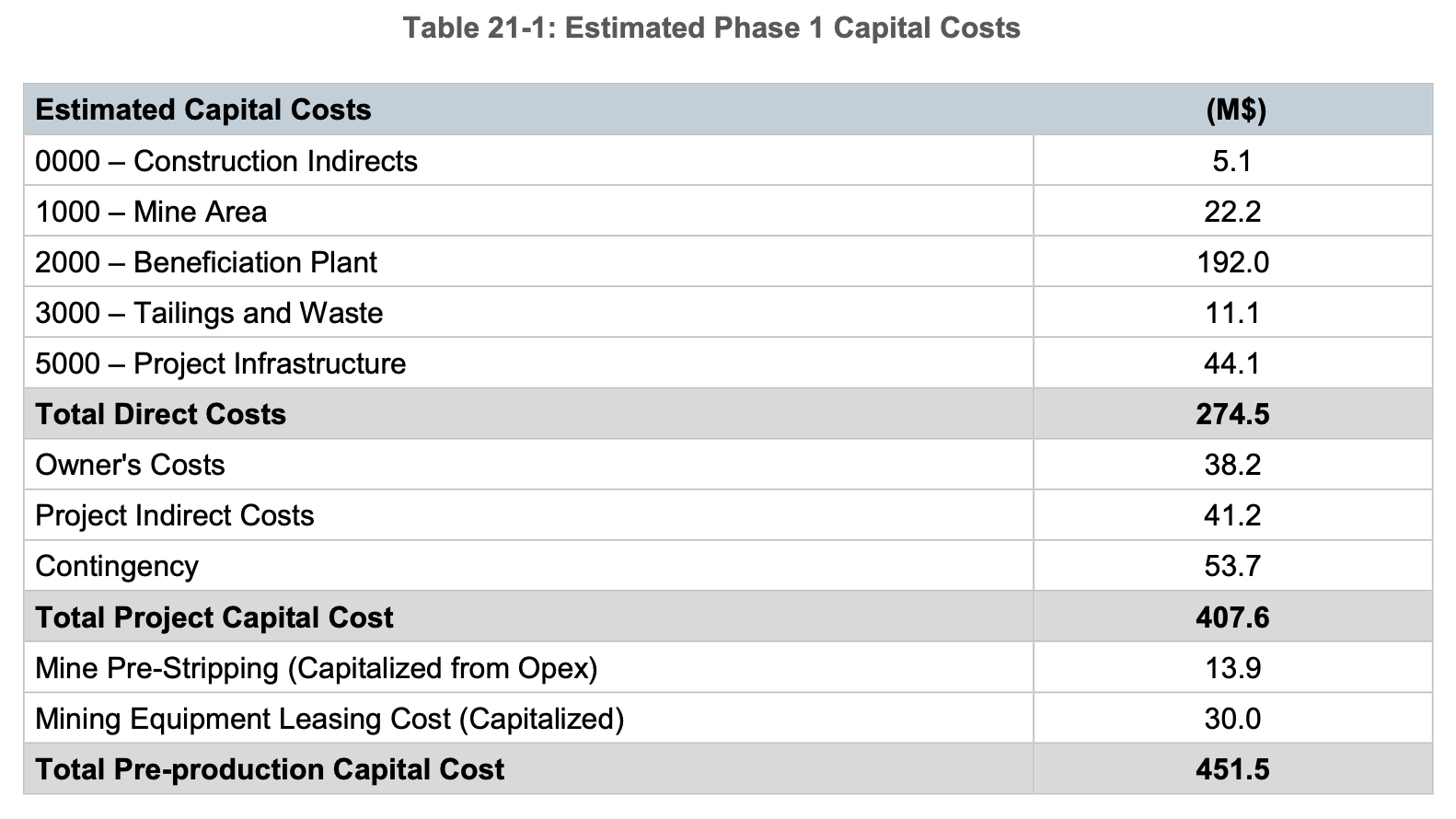

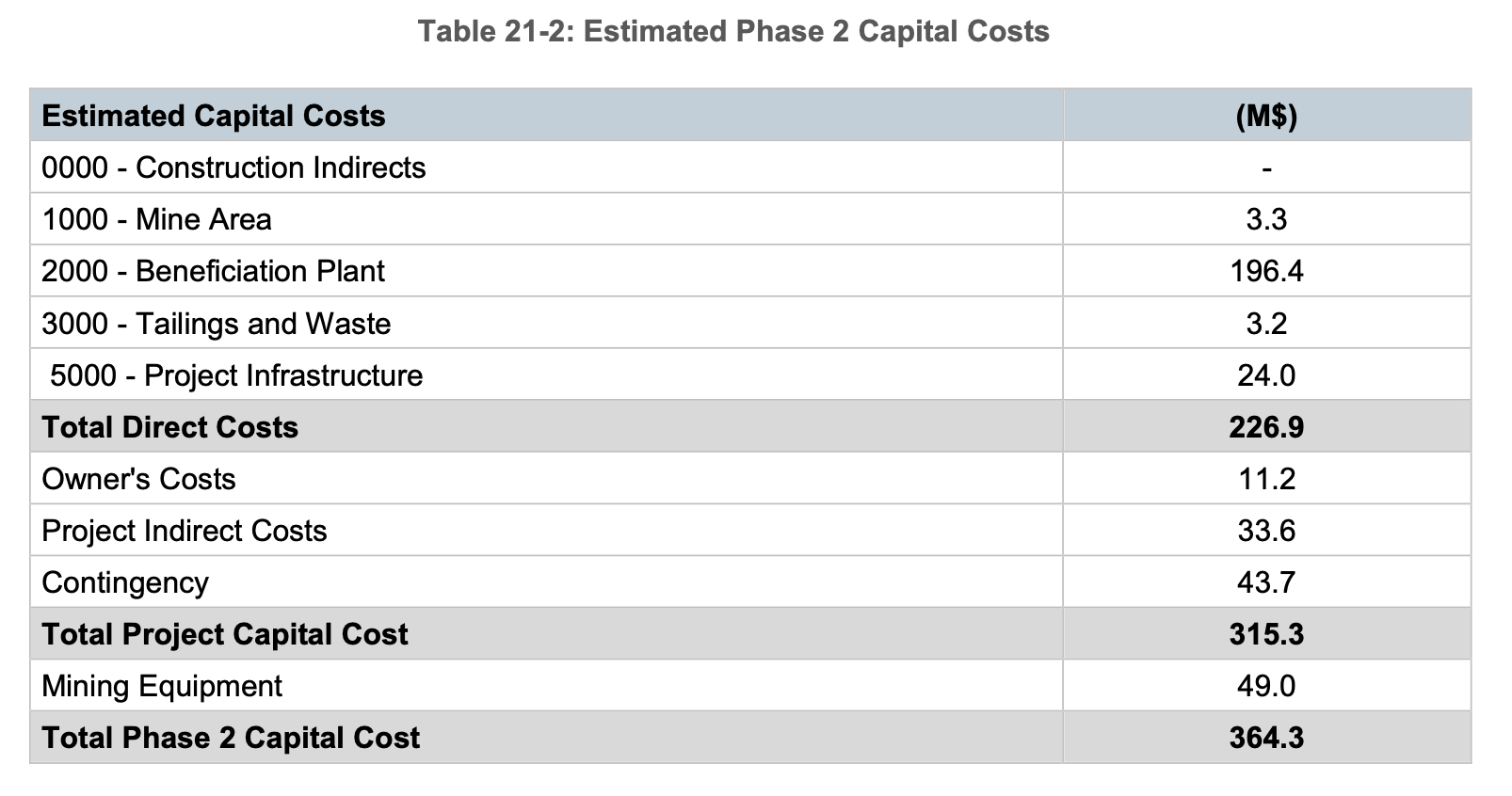

The capital cost estimate in this PEA has been prepared with an accuracy of +/- 35% as per industry standards.

Geology & Mineralization

Exploration & Drilling

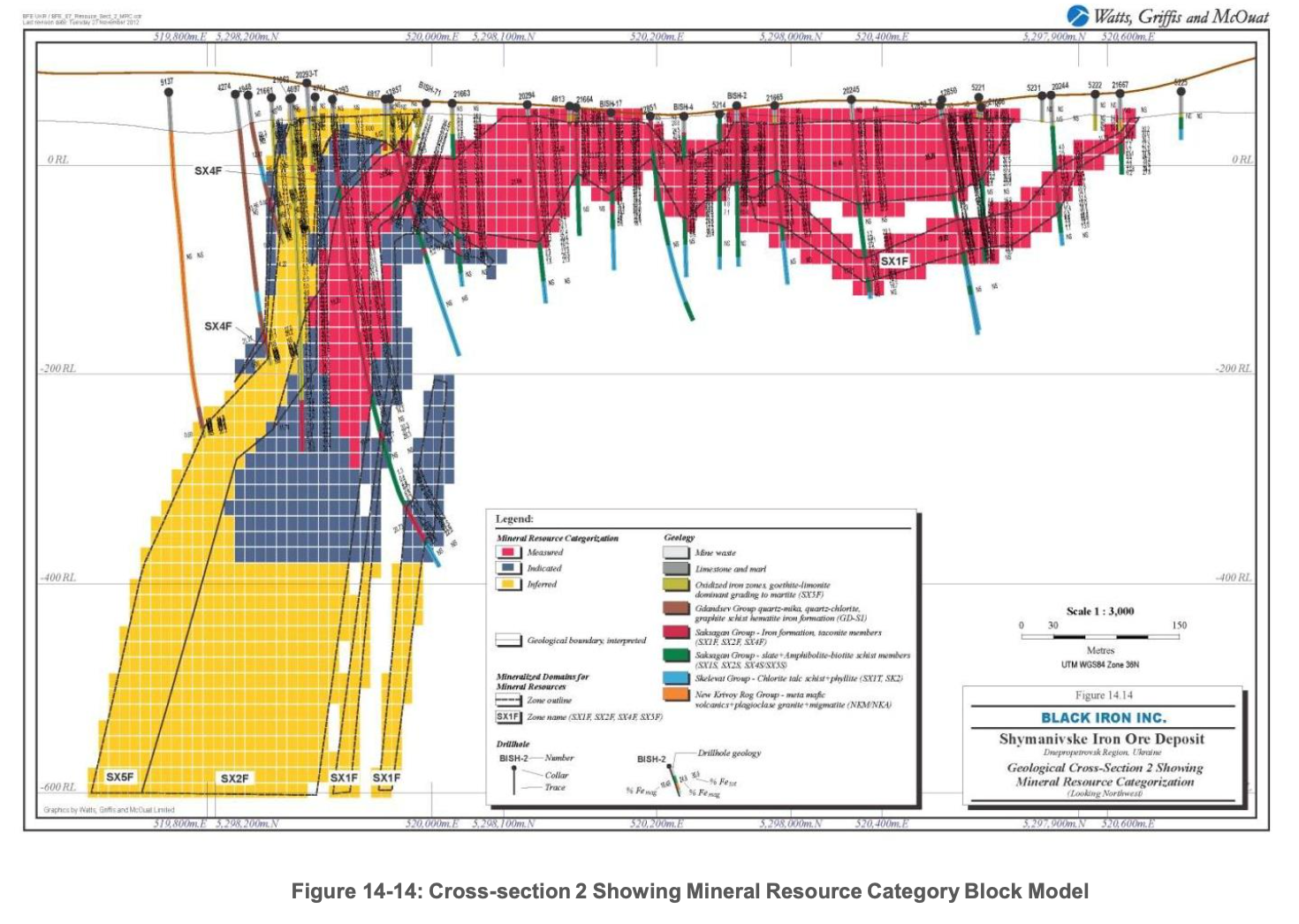

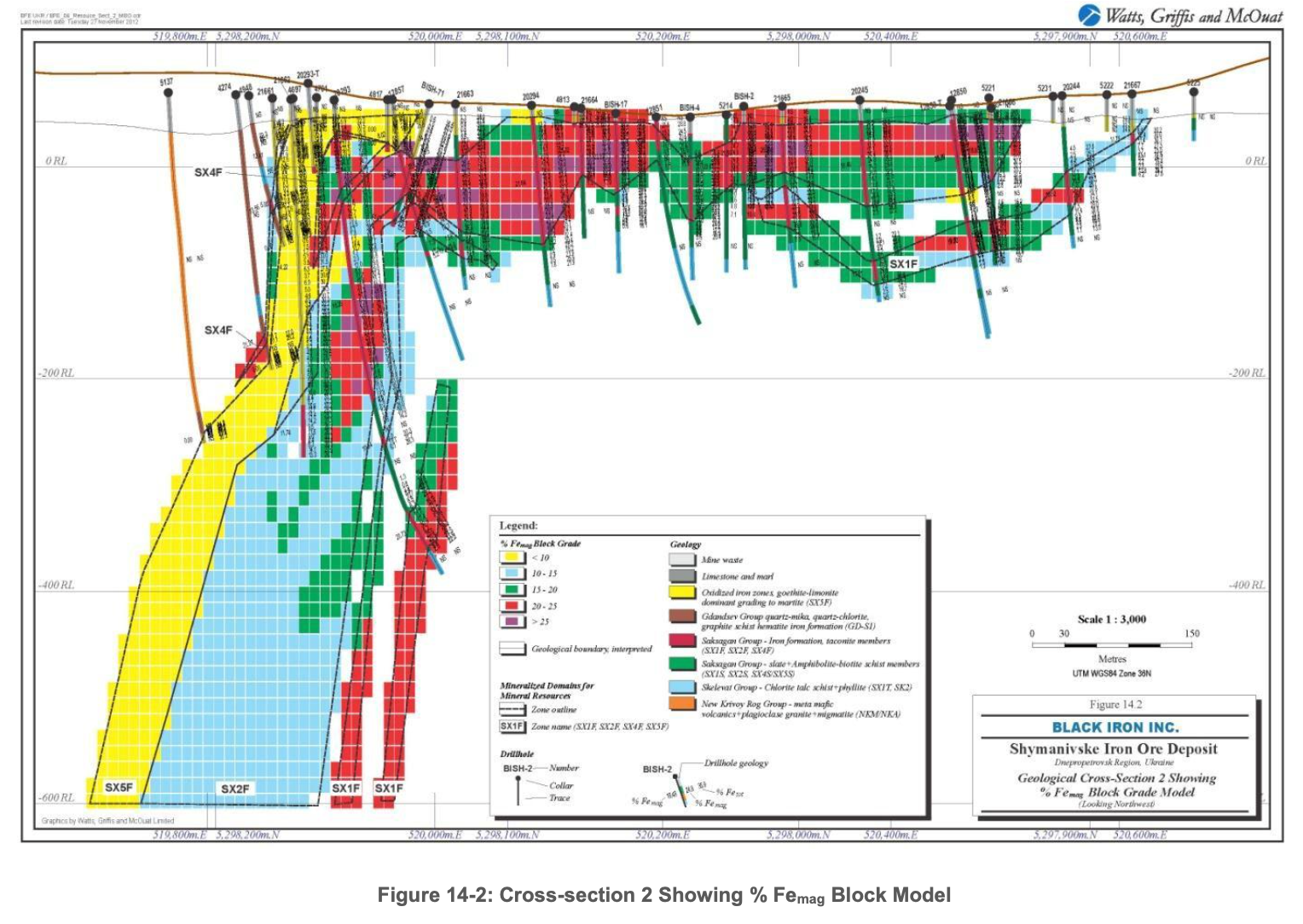

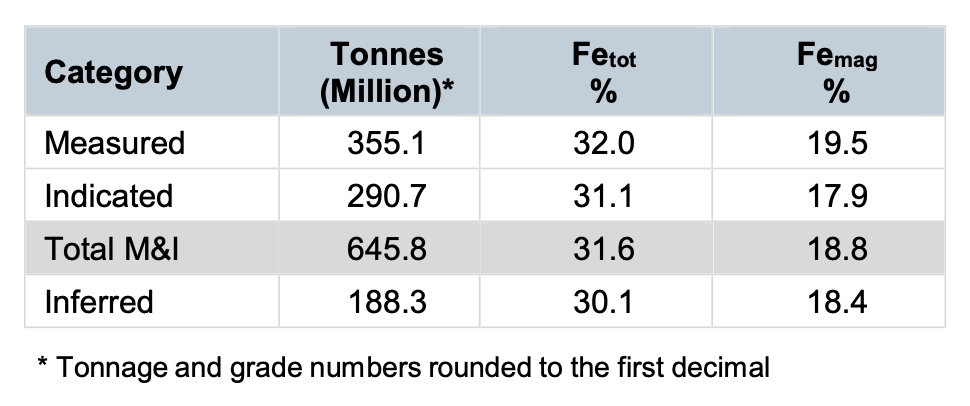

Mineral Resource Estimates

Capital & Operating Costs

Economics

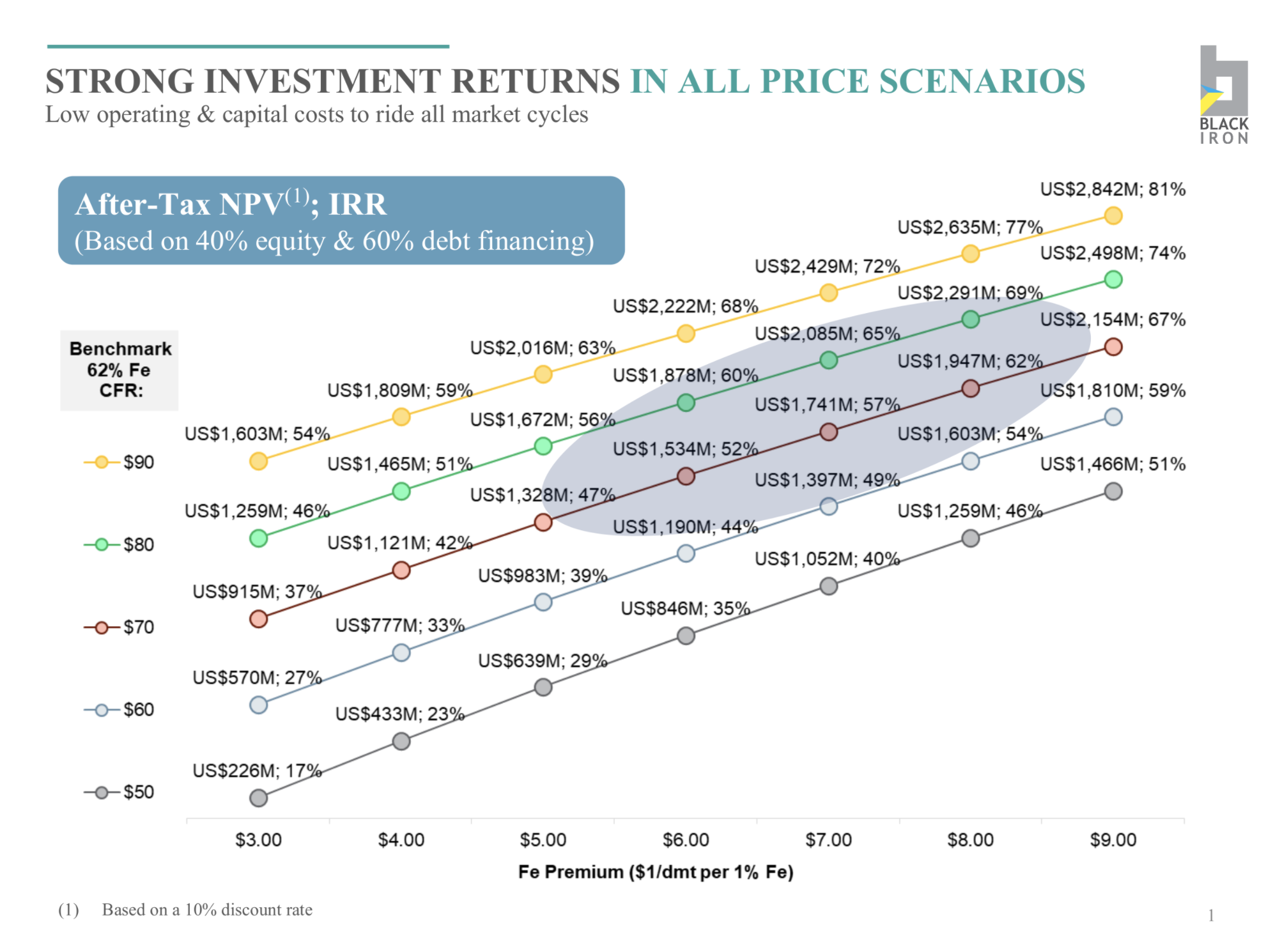

The PEA assumes a long term selling price of US$61.88/dmt for product containing 62% iron content delivered (i.e. CFR) North China adjusting using a premium of US$7.21/dmt per 1% Fe above 62% Fe, which equates to $43.28/dmt for Black Iron’s 68% Fe product, and applying a trace element premium (for silica, phosphorus and alumina), net of penalties, of $3.57/dmt of concentrate. Shipping costs to north China of US$11.54/dmt are then subtracted resulting in the FOB selling price of $97.19/dmt. The economic return at various 62% iron benchmark prices and grade premiums are shown in the table below. As can be seen, the projected economics are spectacular at higher iron ore prices while still being quite compelling in depressed pricing scenarios.

- The resource is defined by approximately 37,000 meters of historical drilling.

- Potential for resource expansion from further drilling at depth.

- National Instrument 43-101 compliant resource report and engineering studies completed.